Tax Brackets 2025 Single With 1 Dependent. It is mainly intended for residents of the u.s. They are $14,600 for single filers and married couples filing.

For example, a $1,000 tax credit lowers your tax bill by $1,000. A dependent is a qualifying child or relative who relies on you for financial support.

Tax Brackets 202425 Uk Kylen Minerva, Most income is taxed using these seven tax brackets, except for certain capital gains and dividends. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

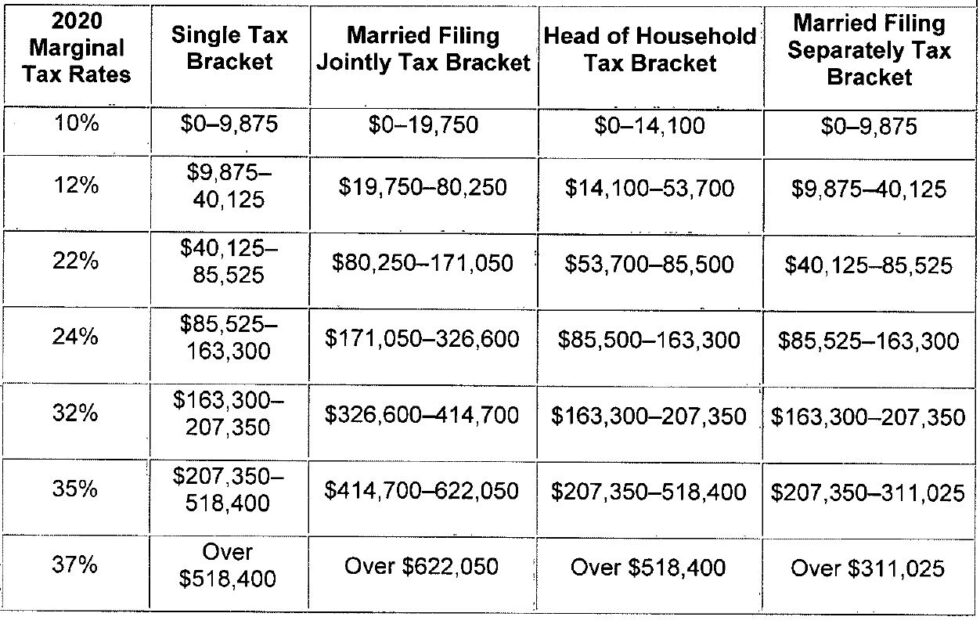

Federal Tax Earnings Brackets For 2025 And 2025 Investor Insights 360, The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Remember, these aren't the amounts you file for your tax return, but rather the amount of tax you're going to pay starting january 1, 2025.

2025 Irs Tax Brackets Chart Printable Forms Free Online, To claim a dependent for tax credits or deductions, the dependent must meet. Now, use the income tax withholding tables to find which bracket $2,025 falls under for a single worker who is paid biweekly.

Us federal tax brackets 2025 vaultseka, These changes are now law. To claim a dependent for tax credits or deductions, the dependent must meet.

2025 tax updates and a refresh on how tax brackets work — Human Investing, These changes are now law. The standard deduction amounts increase for the 2025 tax year — which you will file in 2025.

Effective Tax Bracket Calculator 2025 Lira Valina, On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025. And is based on the tax brackets of.

2025 Tax Chart Irs Wilow Kaitlynn, Tax brackets 2025 (taxes due in. 2025 federal income tax brackets;

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 2025 federal income tax brackets; From 1 july 2025, the.

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Finance Numbers In Brackets Financeinfo, These changes are now law. 2025 federal income tax brackets;