Medicare Tax Withholding Rate 2025. It’s a mandatory payroll tax applied to earned. The social security wage cap will be increased from the 2025 limit of $160,200 to the new 2025 limit of $168,600.

Like social security tax, medicare tax is withheld from an employee’s paycheck or. A consent determination was entered and filed on april 18 th 2025 and april 30 th 2025 between the comptroller of the city of new york and local 237 international.

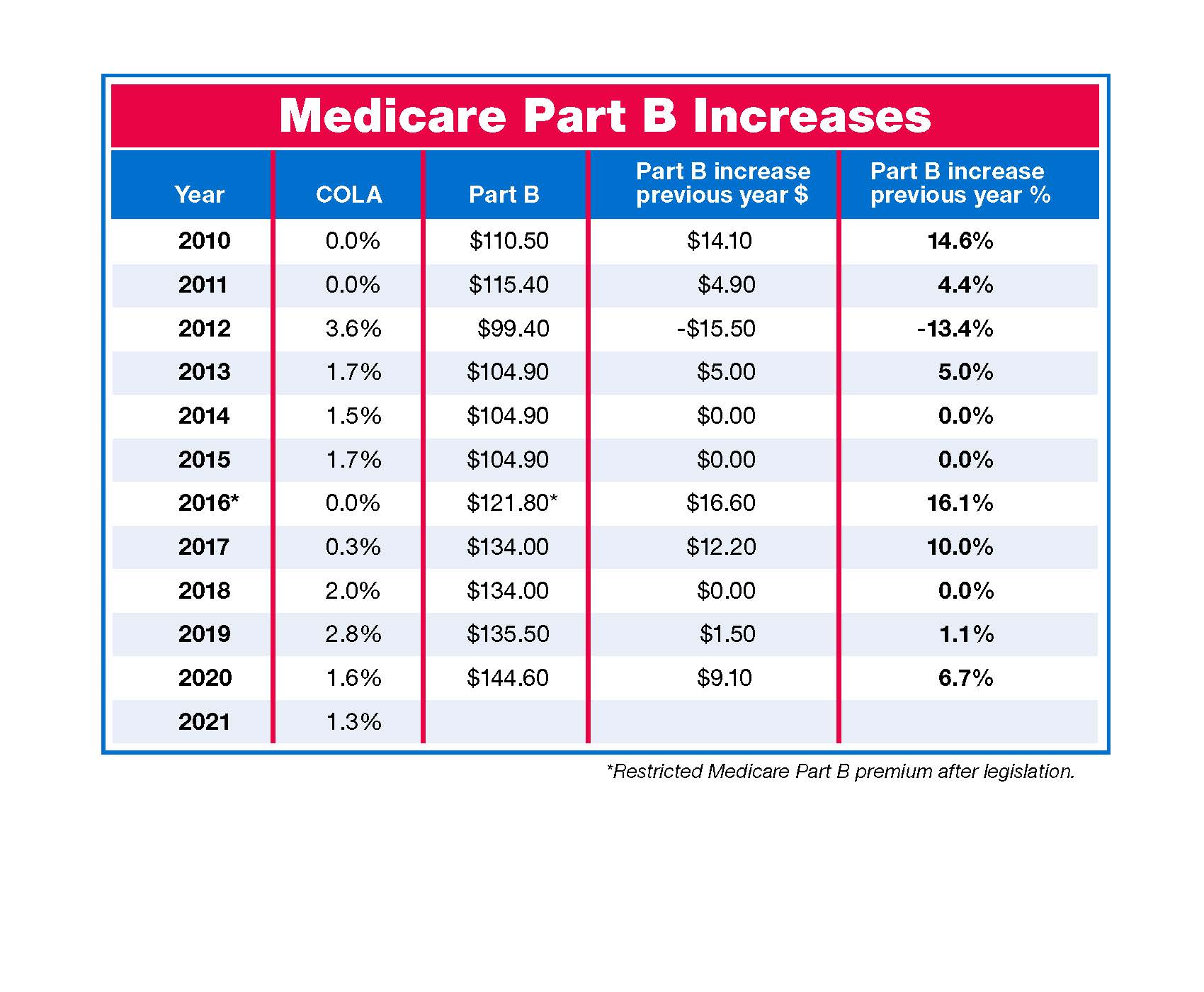

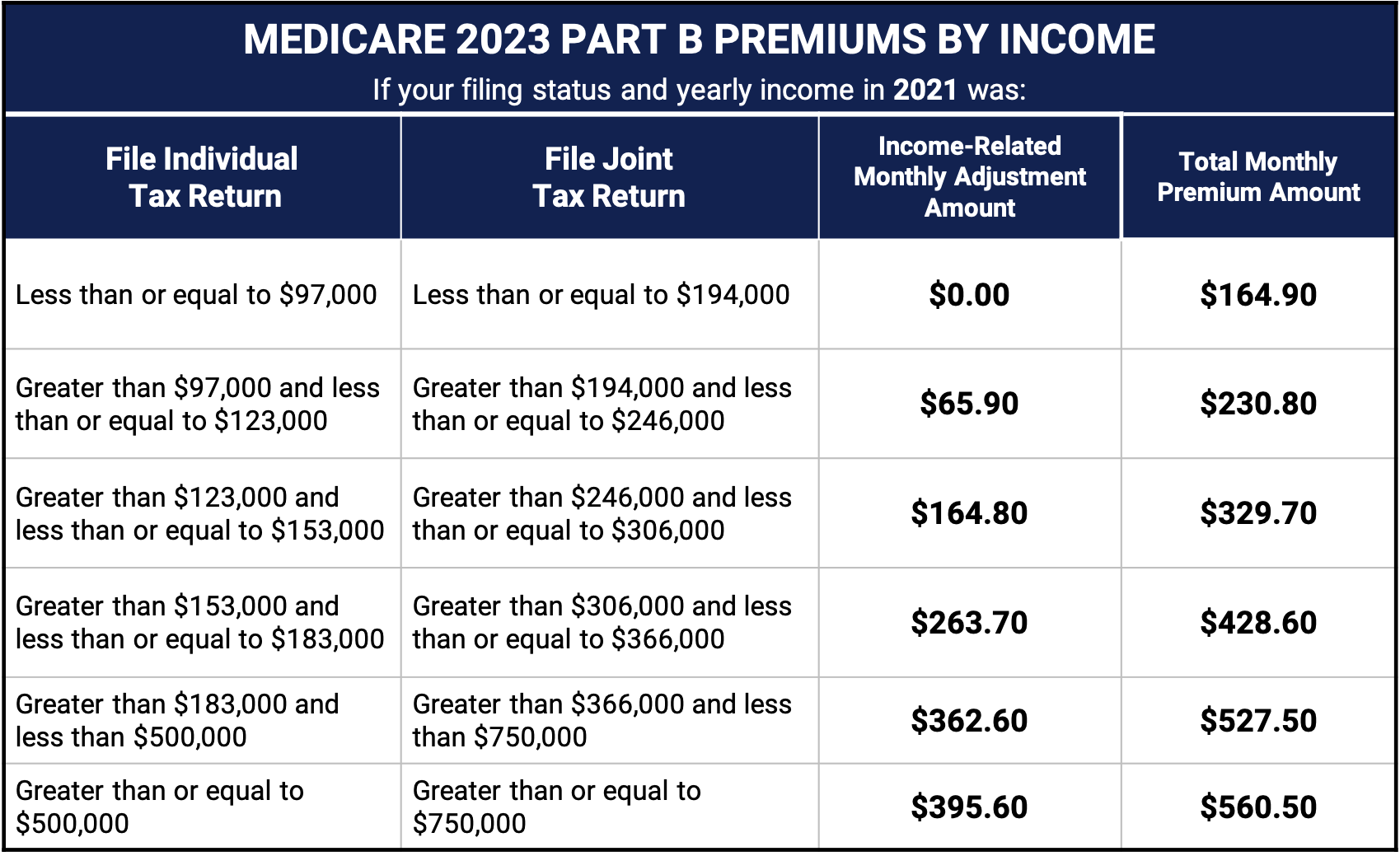

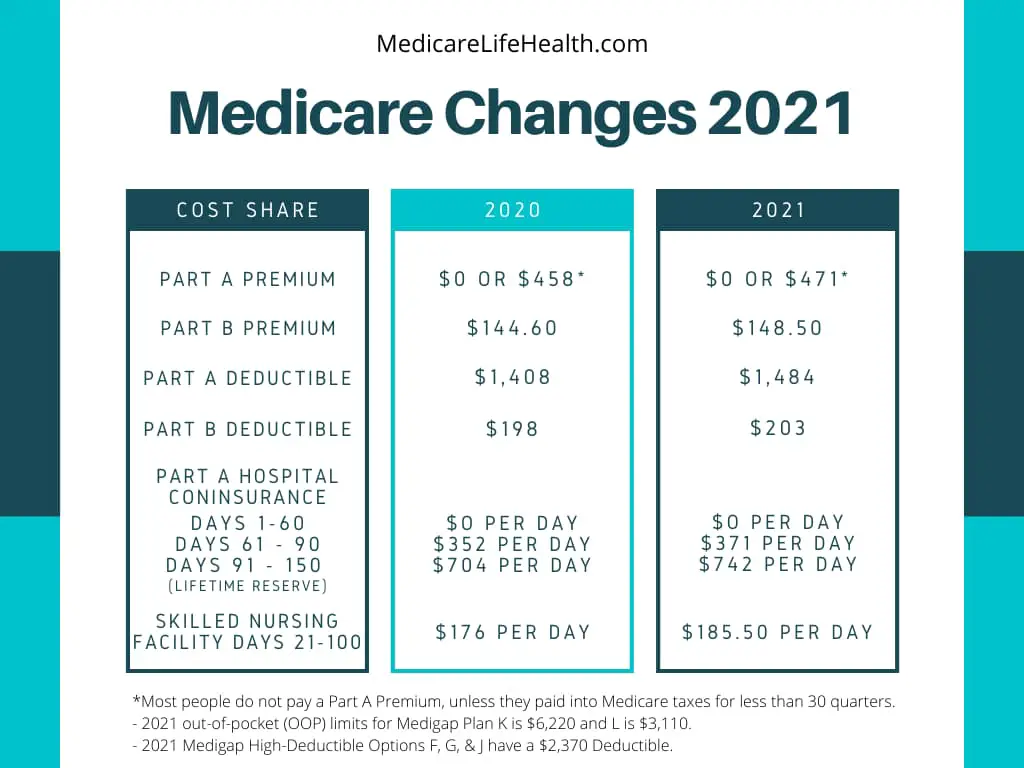

Medicare Limits 2025 Chart Pdf Licha Othilie, The changes that cms has suggested brought the effective growth rate down to 2.09 percent growth in 2025, from 4.75 percent in the 2025 advance notice.

Medicare Withholding 2025 Increase Donna Maureene, 1.45% medicare tax on the first $200,000 of employee wages, plus;

Medicare Limits 2025 Chart Zena Sarette, The medicare tax rate for 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%.

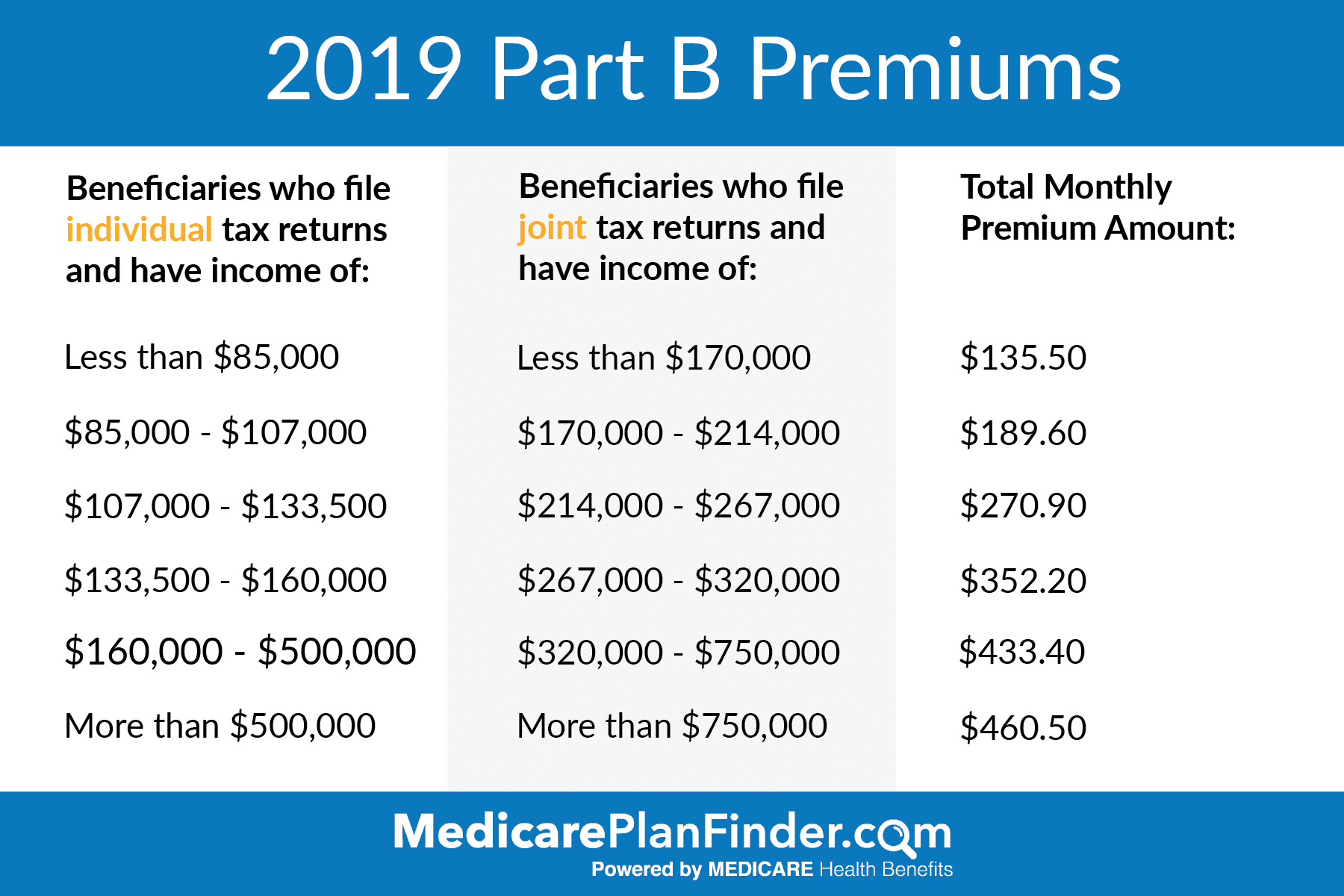

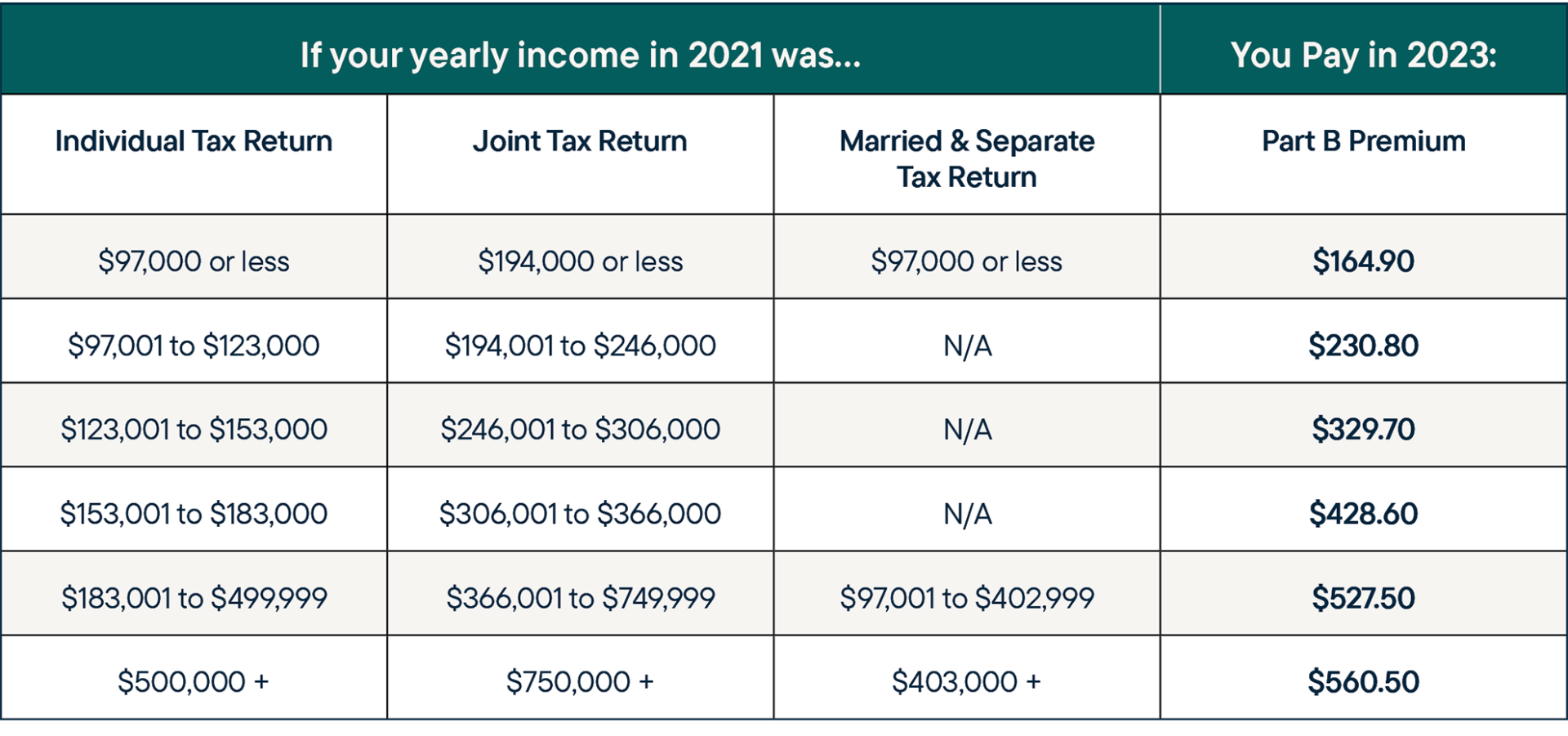

Medicare Premium Tax Brackets 2025 Betty Chelsey, There is no limit on the amount of earnings subject to medicare (hospital insurance) tax.

Medicare Withholding 2025 Increase Donna Maureene, For sole proprietorships and partnerships, business income is reported on the owner’s personal tax return, and the tax rate is based on individual income tax brackets,.

How To Calculate Medicare Withholding 2025 Eunice Catlaina, 1.45% for the employer and 1.45% for the employee or 2.9% total.